Calculating biodiversity footprints in the banking sector

Together with ASN Bank, PRé and CREM developed a methodology for calculating the biodiversity footprint of the loans and investments the bank makes. The insights obtained from the biodiversity footprint show which kinds of investment have the least impact on biodiversity and thus help ASN Bank meet its target of net positive biodiversity impact by 2030.

About

Founded in 1960, ASN Bank is committed to fostering environmental and social sustainability, and to helping create a world that is safe and healthy for people to live in, and where the environment is respected. It thus invests in and helps finance, affordable housing, water management, education, public transport, sustainable energy, healthcare.

Challenge

ASN Bank was keen to know more about the impact that its loans and investments have on biodiversity—their biodiversity footprint. And the bank set the goal to realize an overall net positive impact on biodiversity with its loans and investments by 2030.

Coming up with a way to measure the biodiversity footprint of any activity is complex and time-consuming. Moreover, banks generally do not have the environmental data or the technical expertise required to measure the impacts involved. They have data only about their investments and spending, at a low level of granularity—only for the industries in which investments are made, and not at the level of detail required for this exercise. ASN Bank asked PRé and fellow sustainability consultancy CREM to develop a method to measure, the biodiversity footprint of its loans and investments. It also asked PRé’s advice on how to apply the insights gained from the footprint to reduce the impacts in the future, with the aim of preventing any further loss of biodiversity, and to achieve a net gain in biodiversity, by 2030.

Solution

Based on interviews and discussions it had with experts, policy-makers, and stakeholders, PRé came up with a way to measure ASN Bank’s biodiversity footprint, in part by using an environmentally extended input-output (EEIO) database such as Exiobase. The database can be used to quantify the environmental impact of a product or service whose value is expressed only in terms of monetary flows.

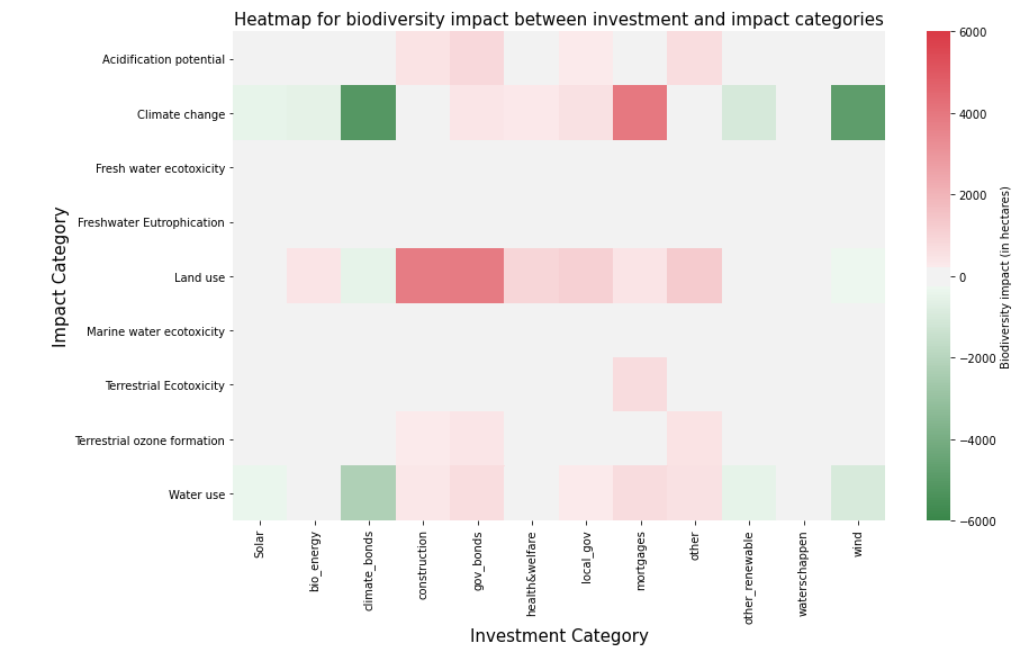

The next step, then, was to translate all ASN Bank’s investments and loans into monetary flows in Exiobase. The ReCiPe method, adapted for biodiversity, was then used to calculate, in hectares, the impact of environmental pressures on biodiversity. Exiobase and ReCiPe were thus used together to determine the bank’s biodiversity footprint.

Under this method, a biodiversity loss of one hectare means that all the flora and fauna living in an area that size are lost over the course of a single year. Similarly, a loss of half a hectare indicates that, in the space of a year, either half the flora and fauna living on one hectare are lost, or that all of them living on half a hectare are lost.

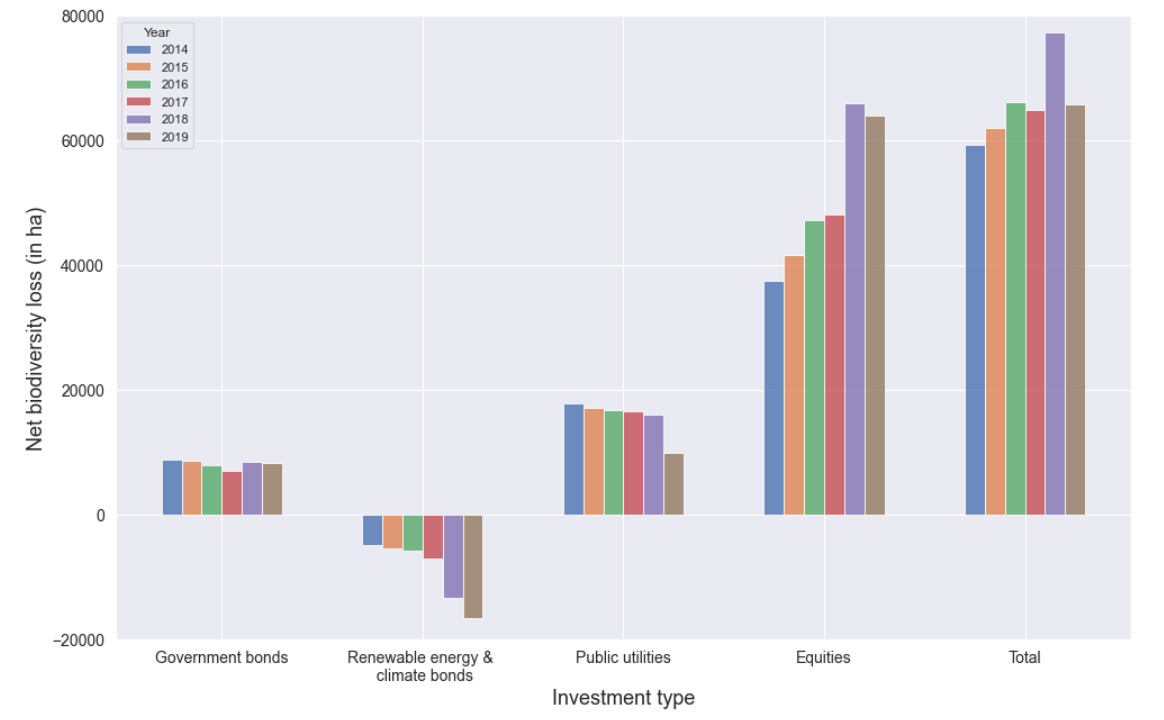

The investments ASN Bank makes can be broadly divided into government bonds, renewable-energy projects and climate bonds, mortgages and residential construction projects, public utilities (health and welfare, railways, and so on) and stocks (in publicly traded companies). Of all the loans and investments ASN Bank makes, it is its investments in stocks that cause the greatest losses in biodiversity. The greatest losses occurred in 2018 because of increased investments in stocks. Since then, however, ASN Bank has invested more heavily in companies whose biodiversity footprint is smaller, and it has increased its investments in renewable energy projects. With these changes, ASN Bank is on its way to contributing to a net gain in biodiversity by 2030.

Benefits

A benchmark value for biodiversity footprint is now being established. It will be based on the activities of 1500 largest listed companies in developed markets, and it will allow sustainability experts and portfolio managers who are weighing whether to invest in a company listed on the index to compare its biodiversity footprint against the benchmark value.

Naturally, reducing the impact that human activity has on biodiversity entails a huge, collective effort requiring sustained commitment from international organizations, national governments, civil society, and the private sector. And the payoff from such efforts is clear: healthier natural environments, healthier social environments—in short, a healthier, more liveable planet.

We have had the pleasure of working with PRé for five years now. We want to achieve our goal to realise an overall net positive impact on Biodiversity by 2030. PRé provides us with robust, high quality, science based information that allows us to take the right steps towards our goal. PRé is helping us to further disseminate the wealth of knowledge we have gained on biodiversity to other financial institutions as well. PRé has an open and collaborative spirit, which makes it a true pleasure to work with their team.

Roel Nozeman, Senior Advisor Biodiversity at ASN Bank, Program Chair of the PBAF initiative

Ready to step up to the next great sustainability challenge?

Learn more about how our team can support you with biodiversity assessment of products, organizations or investments.

Contact the expert

Daniël Kan

Expert